Lululemon (LULU) Stock Deep Dive: Undervalued Gem or Stretched Too Thin?

August 2025 Update

Hey Romstocks readers! Diving into a high-profile consumer discretionary stock this week. We’re stretching our analysis to Lululemon Athletica Inc. (Ticker: LULU), the athletic apparel giant that’s been flexing its muscles internationally but facing some downward dog in the U.S. Market.

With shares last trading $189 as of August 10, 2025 (down 60% from all-time highs), it’s time to ask…

Is this a value trap or a coiled spring ready to break out?

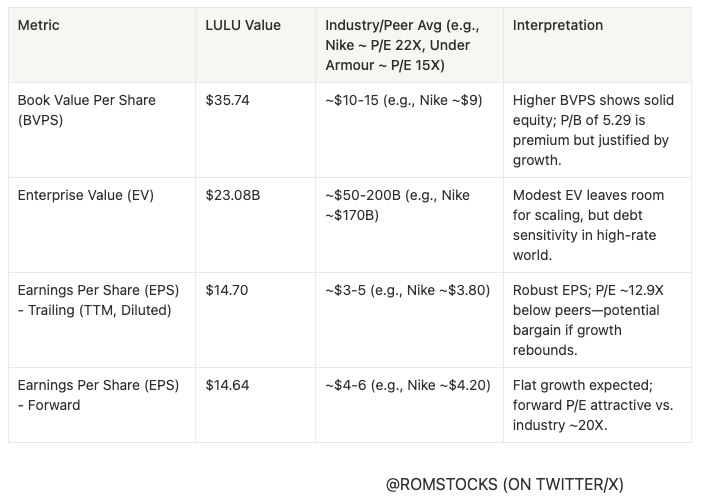

Financial Metrics: Strong Fundamentals Amid Valuation Discounts

LULU's trailing metrics paint a picture of profitability, but the stock's P/E suggests it's priced for perfection... or perhaps undervaluation relative to peers like Nike (NKE). Based on TTM data from Yahoo Finance and the recent 10-Q, here's the snapshot:

Key Takeaway: LULU trades at a discount on P/E but premium on P/B. With EPS holding strong, this could signal undervaluation if international expansion kicks in. No major dilution events in the last 12 months—share count actually dropped via buybacks, boosting EPS.

Dilution Watch: Clean Slate

No red flags here. From August 2024 to now, zero secondary offerings, convertible debt, or big option exercises. Shares outstanding fell from ~121M to 114.7M thanks to repurchases. This anti-dilutive move supports shareholder value amid the dip.

X Sentiment: Bearish Vibes Dominate

Scanning X posts from July 11 to August 10, 2025, the crowd is leaning bearish.

Key themes: 60% drop from ATH, multi-year lows, U.S. demand fatigue, brand dilution, and tariff headwinds.

Tweets: "$LULU hitting 5+ year lows—destruction mode!" or "Tariffs crushing margins; Alo Yoga eating their lunch." A few bulls chime in on undervaluation and global growth, but they're drowned out. Remember, X is echo-chamber central—not gospel, but it mirrors the stock's pain.

Upcoming Catalysts: Earnings on Deck

Eyes are looking forward to Q2 FY2025 results.

Expectations: $2.36B revenue (+6.8% YoY), EPS $2.87 (-8.9% YoY). Beats could spark a rally via international strength; misses might amplify bears.

Other sparks: New launches like Go Further™ Capsule and Align No Line could refresh the lineup and boost men's/international sales.

Timeline: H2 2025. Impact? Positive if execution shines, but uncertain amid competition.

Sector Trends: Athletic Apparel in Flux

LULU sits in Consumer Discretionary/Athletic Apparel, projected to hit $173B in North America by year-end.

Tailwinds: Athleisure boom, sustainability pushes.

Headwinds: U.S. tariffs on imports (China/Vietnam sourcing = cost hikes), slowing consumer spend (~6.5% growth), and inventory gluts.

Broader macro: Lower rates could juice GDP/spending, but trade wars loom. Cross-reference: McKinsey/S&P reports highlight innovation as key. LULU's fabric tech could win, but tariffs might erode margins.

Technicals: AVWAP and DMAs

AVWAP (from Dec 2023 ATH ~$516): ~ $300-350; trading below signals potential value.

10 DMA: ~ $190-200

20 DMA: ~ $200-210

50 DMA: ~ $220-240

(Current Price trading below 50DMA = bearish momentum)

LULU 0.00%↑ is in very oversold territory at this point.

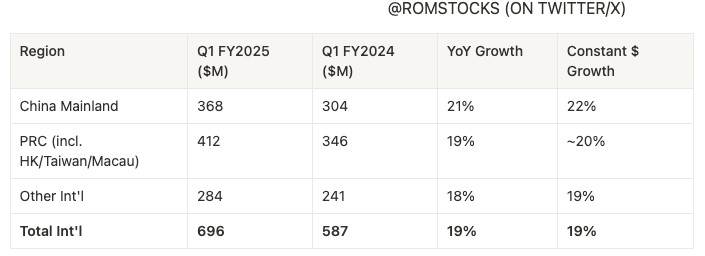

International Revenue: The Growth Engine

LULU's global push is paying off—international now 29% of total revenue (up from 27% YoY). Q1 FY2025: $696M (+18.7% YoY; +19% constant dollar). Breakdown:

Insight: +19% constant dollar growth crushes overall 8%—27 net new China stores since last year. This diversification cushions U.S. softness (comp sales -2%).

Bull vs. Bear Cases

Bull Case: Int'l surge (+19%), product refreshes, and undervalued metrics propel recovery. Target: $300-400 (58-111% upside). Timeframe: 12-18 months if earnings pop and the sector rebounds.

Bear Case: U.S. weakness lingers, tariffs bite, brand erodes. Target: $160-200 (-15% to +5%). Timeframe: 6-12 months on catalyst flops.

Romstocks Verdict: Moderate Buy with Caution

LULU's got solid bones with undervalued P/E, no dilution, and international firepower. However, bears are growling over U.S. demand and tariffs. Ahead of Q2 earnings, this feels like a dip-buy for value hunters betting on global yoga vibes.

It may be worth considering some long dated debit spreads in January to blend your IV premium for potential turn around at these price levels.

Risk: More downside if macros sour. What's your take? Drop comments below—subscribe for more deep dives!

Sources: LULU 10-Q (Q1 FY2025), Yahoo Finance, TipRanks, X trends. As of Aug 10, 2025.

**Not Investment Advice | DYOR (Do Your Own Research*