Deckers Outdoor - Ticker: DECK

Boots on the Ground in a Slippery Ring

Executive Summary

Imagine a seasoned explorer navigating a challenging terrain, where each step demands precision and resilience. This image captures Deckers Outdoor Corporation (DECK), the Goleta-based company behind UGG's comfortable lineup and HOKA's performance-driven footwear. Founded in 1973 with roots in simple sandals, Deckers has evolved into a revenue powerhouse exceeding $5 billion, offering products that combine everyday appeal with dedicated followings. UGG provides warmth for diverse consumers, from families to fashion enthusiasts, while HOKA, acquired in 2012, supports athletes and casual users with innovative cushioning, securing about 10 percent of the U.S. performance sneaker market.

The competitive environment remains intense. Potential tariffs pose risks, with estimates suggesting up to $185 million in additional costs next year. U.S. sales declined 2.8 percent in the first quarter of fiscal 2026, amid concerns about inventory levels, as larger competitors like Nike continue to exert pressure. However, Deckers demonstrates agility. HOKA achieved 19.8 percent sales growth, international revenues increased 49.7 percent, and the company maintains a strong balance sheet with $1.89 billion in cash, no net debt, and an active share repurchase program.

The investment thesis supports a buy recommendation. With a trailing price-to-earnings ratio of 15.94, which is below industry norms, Deckers appears undervalued relative to its growth potential. Anticipated annual revenue increases of 15 to 20 percent, driven by HOKA's expansion and UGG's stability, could elevate the share price to $150 within 12 months. While challenges exist, the company's fundamentals position it for sustained success.

Financial Metrics Snapshot

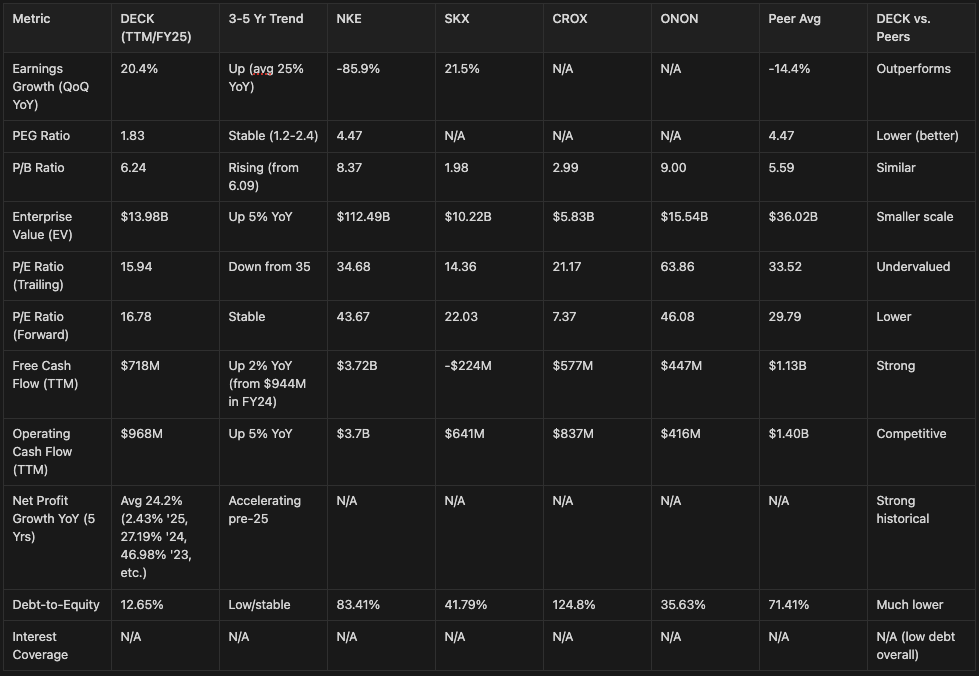

Deckers Outdoor (DECK) exhibits strong fundamentals as of August 13, 2025, featuring high margins, robust cash generation, and minimal leverage. Key metrics demonstrate superior performance in profitability and efficiency compared to peers: Nike (NKE), Skechers (SKX), Crocs (CROX), and On Holding (ONON). Data is drawn from Yahoo Finance and company filings.

Historical trends indicate that over the past three to five years, DECK's revenue has grown at a compound annual rate of approximately 15 percent, while net income has expanded at about 25 percent annually. Free cash flow has more than doubled, rising from $121 million in fiscal 2022 to $958 million in fiscal 2025. Graphical representations would illustrate consistent upward trajectories in cash flows and margins, with DECK's trailing twelve-month margin of 19.31 percent surpassing the peer average of around 6 percent. However, a modest slowdown in U.S. sales during the first quarter of fiscal 2026 is notable. Overall, DECK trails peers in overall scale but excels in margins and debt management, reflecting operational efficiency.

Competitive Landscape and Moat

Within the footwear industry, Deckers operates alongside established players in a dynamic market. Nike leads with approximately 33 percent market share in athletic apparel and footwear, leveraging its iconic branding. Skechers focuses on value-oriented products, Crocs emphasizes casual comfort, and On Holding specializes in high-performance running gear. Deckers maintains about 3.7 percent share in its targeted segments, an increase from less than 1 percent a decade earlier, driven by effective brand development.

The company's economic moat relies on intangible assets and strategic advantages. UGG's sheepskin boots benefit from patents and evoke a sense of seasonal comfort, fostering loyalty among consumers ranging from celebrities to everyday users. HOKA's designs incorporate proprietary foam technologies and unique geometries, protected by intellectual property, which differentiate them in the performance category. Operational efficiencies arise from diversified sourcing, primarily in Vietnam, although tariff risks persist, and direct-to-consumer channels account for 44 percent of sales, enhancing margins at 19 percent compared to the peer average of 6 percent.

Challenges include Nike's extensive research and development capabilities, On's innovative materials gaining traction in running, and Crocs' customizable features appealing to casual markets. Deckers has expanded its retail presence with 48 HOKA stores, including new locations in Milan and Berlin, to strengthen its position. Wholesale channels, representing 56 percent of sales, introduce dependencies on retail partners. In this competitive environment, Deckers' moat provides a solid foundation through brand strength and innovation, though ongoing threats require vigilant adaptation.

TAM and Growth Catalysts

The global footwear market is valued at approximately $500 billion in 2025, according to estimates from Statista and Grand View Research, with a projected compound annual growth rate of 3.5 to 4 percent, reaching $588 billion by 2030. The athletic and performance segment constitutes about $150 billion, while lifestyle footwear accounts for around $200 billion, aligning closely with Deckers' focus areas. With current revenues of $5.1 billion, the company has significant room for expansion, particularly in HOKA's performance running category, estimated at $40 billion and underrepresented in regions like Asia and Europe, the Middle East, and Africa.

Key growth drivers are emerging steadily. HOKA's first-quarter sales rose 19.8 percent to new highs, supported by a 49.7 percent increase in international revenues, including 60 percent growth in Europe, the Middle East, and Africa, and 40 percent in Asia-Pacific. The expansion of direct-to-consumer operations, up 24 percent in the recent quarter, improves profitability. UGG contributed 18.9 percent growth and is exploring apparel extensions. Product innovations, such as refreshed Clifton models from HOKA, address inventory concerns and prepare for seasonal launches, while UGG's GoldenGlow sandals target warmer months.

Potential obstacles include softening U.S. demand due to economic uncertainties and the aforementioned tariff impacts, potentially affecting margins by 50 to 60 basis points. Nevertheless, projections from analysts indicate 15 percent revenue growth for fiscal 2026, with HOKA potentially reaching $2.5 billion by 2028. This trajectory suggests opportunities for broader market penetration, such as increasing adoption in emerging regions, positioning Deckers for continued advancement.

Risks and Valuation

A balanced assessment requires acknowledging significant risks. Proposed tariffs could impose up to $185 million in additional costs for fiscal 2026, with plans to recover only about $75 million through pricing adjustments, potentially compressing margins. The 2.8 percent decline in U.S. sales during the first quarter, coupled with a $354 million inventory increase, raises concerns about overstocking if consumer spending weakens. Competitive pressures persist, as Nike's scale, On's momentum in performance, and Crocs' appeal in casual segments could erode market share. Although debt levels are low at 12.65 percent debt-to-equity, economic downturns might reduce demand for premium-priced products, typically exceeding $150.

For valuation, a comparables approach uses the peer average trailing price-to-earnings ratio of 33.52 applied to DECK's earnings per share of $6.51, suggesting a value of approximately $218. Adjusting for risks with a 30 percent discount yields a target of $150, implying 45 percent upside from the current price near $103. A discounted cash flow model, based on assumptions of 15 percent growth over five years, a 3 percent terminal rate, and a 10 percent weighted average cost of capital, supports a range of $145 to $155. Analyst consensus aligns with an average target of $130 to $137 and an "Overweight" rating.

The recommendation is to buy at prices below $110 and hold to capitalize on upcoming catalysts. Deckers' strategic positioning offers a compelling path forward, despite the inherent uncertainties in the market. As the market broadens out from larger cap names and the usual suspects, I believe utilizing Calendar Calls here would be wise, given Implied Volatility is relatively low for the Oct $110 Calls, hovering around 36% IV and trading around $4.10 per contract.

Traders could also consider diagonal call spreads.

Buying 2x $110 Calls in October and Selling 1x $115 September calls to collect a premium while being net long.

Let us know what you think and leave a comment below!

-Romstocks

**This does not constitute as investment advice and trading is risky. Please do you own research.