Adobe (ADBE) Stock Analysis

Quick Hits for Busy Minds...

Hey fellow subscriber! Today, we’re going to break down Adobe like a cheat sheet. We’ll focus on why this stock could shine (or not). Adobe makes tools like Photoshop and PDFs, but now it’s all about AI Magic.

ADBE stock is down ~33% in 2025 so far, but Q3 earnings just dropped a mic. Let’s dive in with short bursts, bullets, and no fluff. Skim what you need!

Financial Snapshot: The Money Basics

Revenue Power: Hit record $5.99B in Q3 FY2025 (ended Aug 2025) and up 11% YoY. Full year FY2025 now guided at $23.65B-$23.7B (up from prior $23.5Bish). That is solid cash flow growth at 13.6% historically, eyeing 11.9% more in 2025.

Profit Punch: Non-GAAP EPS crushed at $5.31 vs expected $5.18. Operating Margin? A Juicy 46.3%

Balance Sheet: Strong cash position, subscription model keeps money flowing. No debt drama.

Key Ratio Quickie:

P/E: Around 35X (growthy but not insane)

Cash Flow: Generating billions; FCF up big time.

Bottom Line: Finances are healthy. No red flags screaming “sell now!”

Growth Story: Where’s the Upside Coming From?

AI Turbo Boost: Adobe’s jamming AI into everything like their Firefly (image gen)…which is exploding btw. Digital Media ARR (annual recurring rev) grew 12% YoY in Q3.

Segment Wins: Creative Cloud (think Photoshop) up 10% … btw such a sticky subscription. Almost impossible to cancel from, and they have early term fees which keep the sub model kicking along. Document Cloud (PDFs and more) up 18%. Experience Cloud (marketing tools) is holding steady at 8% growth.

Overall Trend: 11% YoY revenue growth in Q3, beating estimates. Subscriptions = predictable rocket fuel. Expect mid-teens growth if AI hype sticks.

Global Reach: 30k+ employees, diversified across creative pros, businesses, and now AI for everyone.

Growth’s real, driven by digital shifts, but watch for slowdown if the economy hiccups.

Quarterly Outlooks: What’s Next Short-Term?

Q4 FY2025 Guidance: Revenue $6.075B-$6.125B (up ~11% YoY). EPS $5.35-$5.40 (beating street guesses).

Full Year Outlook: Raised targets show confidence. Digital Media ARR to grow $2.58B (up from $2.5B prior).

Beat Streak: Adobe’s crushed earnings for quarters now. Q3 was a 1.4% revenue beat.

Short Take: Optimistic, but stock dipped post-earnings. Markets are picky and need more AI proof to ride that wave. Again, a good company doesn’t always make a good stock, but eventually it will show with a long enough time horizon.

Pending Catalysts: Events That Could Pop the Stock

Adobe MAX 2025: Oct 28, 2025 … maybe some big AI reveals?? Investor Q&A could drop Firefly upgrades or new tools. I would actually anticipate this based on the other image AI platforms producing more image/video-generating tools. I think Adobe may show some promise for a lot of media editors.

AI Rollouts: More Firefly integrations, video AI (like Sora rivals). I would also keep an eye on FIG 0.00%↑ Figma for its relation to Adobe as a strong competitor in the space.

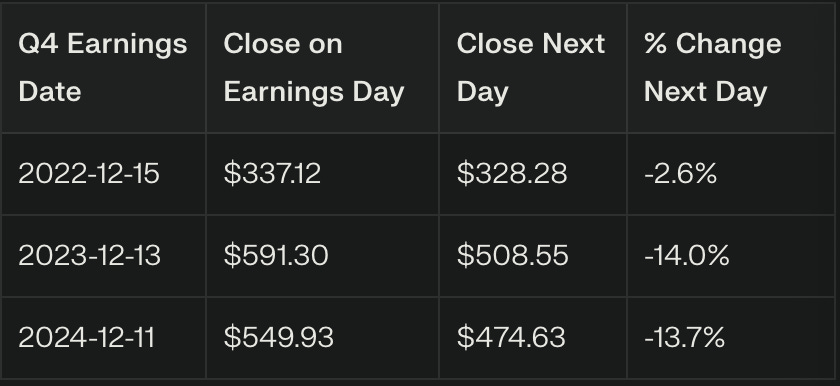

Earnings Report in December 2025 for Q4. Historically, Q4 ER has usually been a sell-off event for Adobe. Despite them posting headline beats, the market was usually disappointed with guidance.

Here’s a snapshot of that:

Maybe a Bear Risk Reversal (sell a call / buy a put) strategy might print a nice profit here.*

Key Drivers: What Fuels Adobe’s Engine?

AI Everywhere: Infusing AI into Creative/Experience Clouds, such as generative fill in Photoshop, smart PDFs. Driving user stickiness and upsells.

Subscription Shift: 95% recurring revenue = steady income. No more one-off buys.

Market Trends: Digital transformation boom. Businesses need marketing tools, and creatives need AI speed.

Competitive Edge: Vs. free tools like Midjourney/OpenAI/Grok, etc, Adobe’s enterprise focus on security and integration wins big corps.

Risk Drivers: Economic slowdowns hit ad spend; AI disruption from cheaper rivals.

Insider Transactions: What are Execs Doing?

Recent Moves: In the last 3 months, no buys but insiders sold 8,995 shares (net sell activity). Over 12 months: Bought 3,550 shares, sold 119,735 (mostly routine vesting/sells).

Notable Ones: CFO Daniel Durn bought 1,300 shares in March 2025 at $3.90.58 ( ~$508k), so a bullish signal then. No panic sells post Q3.

Overall: Mild selling, but insiders own ~0.3% total. Not alarming, but typical for tech giants.

Bull Scenario: 6-12 Month (Target: $450-$500)

AI Dominates: Firefly and new AI tools (like video gen) crush it and revenue surges 15%+ YoY. MAX 2025 & Summit 2026 events drop bombshell features, pulling users from rivals.

Growth Rebound: Economy perks up; Digital Media ARR hits 18% growth. Marketing spend booms, Experience Cloud accelerates. EPS tops $24; P/E stretches to 38x on hype.

Upside Math: The current stock price is hovering near $350. If our target of $450-$500 hits, we could see a 28-42% return on just owning the stock. Additionally, catalysts like partnerships or acquisitions fuel the rally. If the AI narrative catches first, and the economy is still bullish, it’s possible we could test $600 later on that time horizon.

Bear Scenario: 6-12 Months (Target: $250-$300)

AI Stumbles: Free/Open-Source rivals (e.g. Midjourney evolutions) erode Adobe’s edge; Firefly monetization flops. Users balk at pricing, subs churn.

Growth Hits Wall: Q4/FY2025 misses on weak demand; broader tech recession drags ad budgets. Revenue growth slows to single digits; stock tanks another 15-30%.

Downside Risks: More regulatory AI scrutiny, insider sells ramp up, or failed events. From $350, that’s a 14-29% drop. Worst case: -20-40% if bears win big here.

Final Thoughts:

Options implied volatility is hovering near 35%. Great for buying directionally here (long or short). You can also spread out your risk with calendar spreads for either side.

Ultimately, Adobe is a giant $147B company. They have lots of cash and most likely will need to have strong guidance and acquisition targets to juice up excitement going forward. There are too many potential AI tools that will ultimately steal their crumbs of business and lead to a crack in their rev pie.

Also, if the economy does start to weaken in 2026, the first place big corps will cut is people and licenses. So their subscription revenue, which is the majority of their business, will dwindle. However, Adobe still holds the golden standard for a lot of media businesses, independent creatives, and other corporates when it comes to their tools.

It’s also possible to consider if rate cuts are more / larger than the market anticipates, this could fuel more money pouring into AI projects in 2026. Which ultimately means that Adobe could have nice targets to acquire (bullish). Just a thought. They have nearly ~$6 billion in cash as well.

As always, do your own research; this is not investment advice.

UNTIL NEXT TIME…